I’ve decided to give Threads another go, given that Twitter is less and less useful (if not actually harmful), and no one wants to see me put up a LinkedIn post every time I see something interesting (I find lots of things interesting).

So if you’re playing in that sandbox, I’m brianbreid.

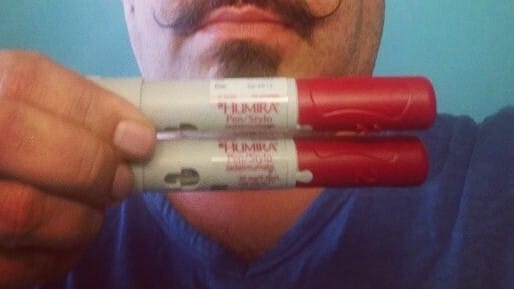

Here’s something to stay dialed into as earnings season begins: AbbVie has apparently managed to keep more than 97% of the market for Humira, even with biosimilar competition.

That’s per a report from Samsung Bioepis that was picked up by Endpoints. It’s hard to tell whether the numbers fully account for the bevy of biosimilars that hit the market in July, but it definitely reflects the competition (or lack thereof!) from the Amgen version that launched in January.

AbbVie’s earnings will happen two weeks from Friday, pre-market, and it’s likely that investors will be curious about a couple of things.

First off, how hard has Humira had to compete on price? Sure, they’ve maintained share, but have they done that by upping rebates? Second, what other factors might be contributing to the market-share dominance? AbbVie is writing a playbook for keeping biosimilar competition at bay, and investors will be keen to peek at the approach.

The broader question, though, is whether all of this “success” is going to engender additional scrutiny and blowback. This is clearly not a market working the way it is supposed to. Many biosimilar companies have tried to be clever by introducing high-priced products with high rebates, but the Amgen experience suggests that it’s hard to beat AbbVie at that game.

As for the low-priced products, PBMs aren’t doing a lot to promote that approach, either, which isn’t a good look for that industry. So there are products that are unquestionably a good deal — especially for those with coinsurance — that are sitting unused and unincentivized, even as some patients get hammered.

PCMA, the PBM lobby, has a new poll out that suggests that employers love their PBMs, and find them transparent and helpful and handsome and strong.

For PBMs, that’s proof that their ultimate customers — the employers — are happy, and everyone else can kiss off into the air.

But there’s enough weirdness in the survey toplines to give pause. Adam Fein flagged that most of the employers surveyed aren’t getting rebates back (which, as Adam’s audience noted, might be a quirk of the survey, which was weighted toward self-insured employers). And a majority of those polled didn’t know what “spread pricing” is.

So it may well be that employers are happy with their PBMs. It may also be that a lot of employers are not paying particularly close attention.

Elsewhere:

OK, OK: just one obesity link today, but it’s an interesting one, about a woman in Washington State that is suing to have her state-government insurance cover Wegovy, claiming discrimination.

Pepsi doesn’t think obesity medicines are eating into its sales, so that’s technically NOT an obesity link.

Steve Forbes, writing for Fox News, provides a lightning-round op-ed that tries to bake in every possible objection to the IRA.

Reuters covered efforts by Down Syndome advocates to broader access to new Alzheimer’s drugs.

If this email was forwarded to you, and you’d like to become a reader, click here to see back issues of Cost Curve and subscribe to the newsletter.

And a PBM-sponsored survey shows that employers love PBMs Read More Cost Curve