The PhRMA Medicines in Development reports are almost hard to read because it’s hard to wrap your head around some of the numbers. The latest from the group looks at cancer drugs and finds 1,600 medicines in the clinical pipeline. That’s an incredible figure, and it speaks to the depth of innovation happening right now.

The whole thing is worth the read.

I see a couple of broad takeaways. The first is that this is proof of an amazing innovation engine. Cancer is almost unimaginably hard, biologically, yet the past 30 years or so have seen researchers unlock pieces of the puzzle, one mechanism at a time. The report quantifies that.

The second takeaway, and this is the one that I worry will be missed, is that blossoming of innovation in cancer is proof that incentives matter. There was a time, before the Medicare prescription drug benefit, when oral cancer medicines were a commercial dead end.

But once Medicare began covering those therapies, there was a path to generating a return on that R&D investment. The PhRMA paper notes that there are nearly 700 small molecules in development, which is a testament to the impact of Part D.

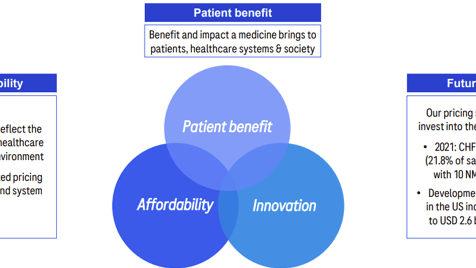

The fact that cancer medicines are broadly reimbursed without a lot of hurdles, has also helped lift research in oncology. I can’t think of a cancer drug with a strong clinical profile that hasn’t been a success on the market, which further helps companies invest with confidence. (This doesn’t happen in every therapeutic area.)

All this doesn’t mean that the incentive structure is perfect, but it is a reminder that when a health system offers certainty and some assurance of a return on investment, you get breakthroughs.

There’s going to be so much Zepbound coverage, but I stand by my take from yesterday that the pricing and reimbursement element is the main element — and maybe the only element — worth watching. Along those lines, Barron’s and Bloomberg looked a bit deeper at the market dynamics. I don’t think either piece broke new ground, but it seems like there is an emerging understanding of exactly what’s going on here with list and net prices.

Optum Rx is going to cover eight insulins from the major insulin manufacturers on the lowest cost-sharing tier of its standard formulary, a move that the company said would mean that 98% of the patients it covers will have access to their insulin at $35 a month or less. This feels like another modest step in the right direction, but I haven’t seen much commentary, and I’m usually in trust-but-verify mode when it comes to PBMs. Does anyone have a good reason to cynical here?

This is a nice interview with AstraZeneca’s Pascal Soriot. The company’s IRA messaging is well done: acknowledge the good things about the law and then offer a forward-spinning, action-oriented approach to the bad things. (In the case of AZ, that means pressing for a fix to the orphan-drug provisions of the law.)

We’re going to learn a lot about how CMS views biosimilar competition through the lens of the IRA from the ongoing Stelara-biosimilar approval and launch, per this piece from Bloomberg Law.

I’m almost caught up on the CMS listening session transcripts … Imbruvica and Januvia are now in the archive. ngl: the longer this goes on, the angrier I get about the missed opportunity. Having the same speaker give the same speech, regardless of which drug is being discussed, isn’t enlightening anyone, and there’s no question that CMS could have made this enlightening if they’d given it a moment of thought.

If this email was forwarded to you, and you’d like to become a reader, click here to see back issues of Cost Curve and subscribe to the newsletter.