Scheduling note: Curve off tomorrow. Might be off Monday, too. I’m headed east tomorrow morning, and I’m not stopping until I get to the Atlantic Ocean.

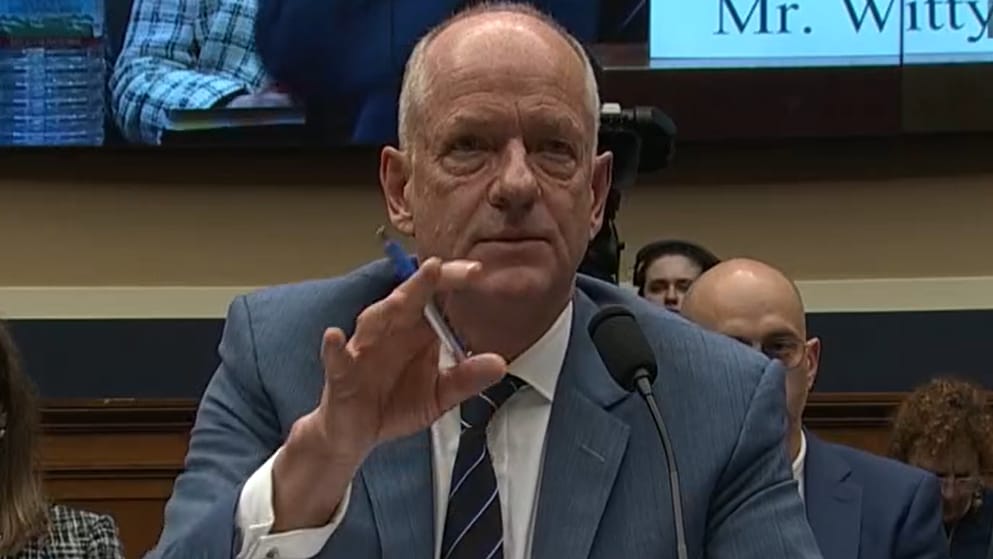

There’s not much I can say about UnitedHealth Group CEO Andrey Witty’s testimony before Congress yesterday that hasn’t been said. Everyone knew he was going to get shellacked, he got shellacked, and now the question is what lawmakers are going to do about it.

The popular answer is to break up the company, which feels fun and bold and unlikely. It was a bigpart of the dialogue yesterday.

Again, I don’t want to get too deep here unless we see words turn into actions, but I should note one really interesting part of Witty’s testimony. When defending United against claims that it was too big, he noted a couple of areas where the company had not vertically integrated, including this line:

“We do not own any drug manufacturers.”

That caught my eye because two of Witty’s biggest health insurance competitors — CVS and Cigna — now do own drugmakers (of a sort). I don’t take this as a commitment that United wouldn’t follow their lead, but there’s now a paper trail in the event Optum tries to launch a Cordavis or Quallent-type object.

“This is challenging a novel, unprecedented price-setting program in a setting where the government is the 800-pound gorilla … How would this at all be lawful in any way?”

That’s a quote yesterday from a judge at the appellate court hearing in the PhRMA IRA case. It’s one of a handful of zingers that Judge Jennifer Elrod threw at the government lawyer defending the case.

(If you didn’t hear about the hearing, it’s because — weirdly — no one really covered or even mentioned the arguments. I pulled the quote above from Reuters, and Bloomberg Law has a piece. Beyond that: 🦗🦗🦗. If you want to hear what everyone else missed, the audio is up on YouTube.)

I don’t think it’s wise to read too much into the one comment. Elrod is part of a three-judge panel (the other two judges said nothing during the argument), the main issue before the appeals court is kind of narrow and lacks overlap with some of the other cases, questions asked in argument are not necessarily reflective of a judge’s legal reasoning, etc.

Still, after almost a year of legislative efforts to detail the IRA, there haven’t been many (any?) judges who have even vaguely entertained the possibility that the government is throwing its weight around in ways that aren’t permissible.

Worth watching.

Shot: This interview with Jon Mahrt, OptumRx’s COO, in which he whines that new GLP-1 indications are driving up prices.

Chaser: The news that Wegovy prices fell last quarter.

It feels like PBMs are going to have a credibility problem around pricing (if they don’t already do) as the rebate debate heats back up.

Elsewhere:

This is a nice Biospace piece reminding everyone that, yeah, the IRA is going to impact development. It’s based on some smart comments from Incubate’s John Stanford. The impact-on-innovation narrative has been muted somewhat by industry’s skittishness around talking specifics, so I’m happy to see the concept remains on the radar.

Following in Lilly’s footsteps, Pfizer apparently has plans to build some sort of platform that incorporates telehealth at the front end and pharmacy fulfillment at the other end to create a more direct-to-consumer health model. Curious to see the evolution here. Nice scoop by Oliver Barnes at the FT, who is on a roll lately.

Here is ADVI Health’s Sarah Butler making a point to Pharmacy Times that you’re going to hear a lot more about over the next six months: there is no guarantee that price controls are going to make drugs cheaper or more accessible for patients.

You all know that I find the dialogue around inhalers to be worthless and impossible to adjudicate without real pricing data, but that hasn’t kept things from getting frothy, politically. Here is the latest, from Sen. Maggie Hassan, on the issue around generic Flovent.

It’s not good that this idea has taken nearly 18 months to break through (and it might not be breaking through even now), but I’m glad we’re getting some acknowledgment that placing biosimilars on a formulary at parity with Humira is not going to drive biosimilar adoption because there’s very little motive to switch patients to a less-expensive option in that scenario. Boehringer made that point explicitly this week, and I hope understanding of that basic point starts to sink in.

I feel like I’m usually pretty good at LinkedIn (feel free to follow!), so I feel some shame that I didn’t notice this great article last week by USC’s Dana Goldman poking fun at Bernie Sanders’ tenuous grasp of pharma economics. The whole thing turns on a maple syrup analogy, and I love maple syrup.

If you’ve read this far, you’re a fan, and I appreciate you. Please consider forwarding to a friend and encouraging them to subscribe.