If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

A couple of weeks ago, I got pretty whiny about the fact that there were a hundred thousand stories about the FTC getting tough on Orange Book patent listings and that nearly all of the stories omitted an incredibly important element: the FDA is actually the agency that oversees the Orange Book, and that agency has done jack-all squat to clarify standards.

So credit where credit is due: Ed Silverman at STAT is out with a story today that goes into incredible detail about where the FDA has — and has not — been on the Orange Book issue.

I’m hoping that Ed’s piece can reset the dialogue a little bit. The Orange Book story is not (or ought not) be about the FTC’s threats but rather what the proper standards and processes should be.

It’s worth your time.

Holy moly is there ever a lot of data to get through all of a sudden. I’m up to my eyeballs in charts and graphs and PDFs. I’m not going to get through it all today.

So what am I not going to get through? This PSG report on the state of the specialty pharma business, for one.

And tomorrow I’ll go into more detail on IQVIA’s look at 340B, though you should be tracking on the topline number: 340B sales hit $124 billion last year, up more than 16% from 2022.

There’s also a section in the Rand report about hospital prices that I want to go at. But there’s a lot of the week left.

***

Today, I want to look at IQVIA’s mammoth, annual look at the U.S. pharmaceutical market. I’m a total fanboy for this stuff.**

There are seven million narratives buried in the report, but I want to focus on the ones that I’m most interested in: where have drug prices been? Where are they going?

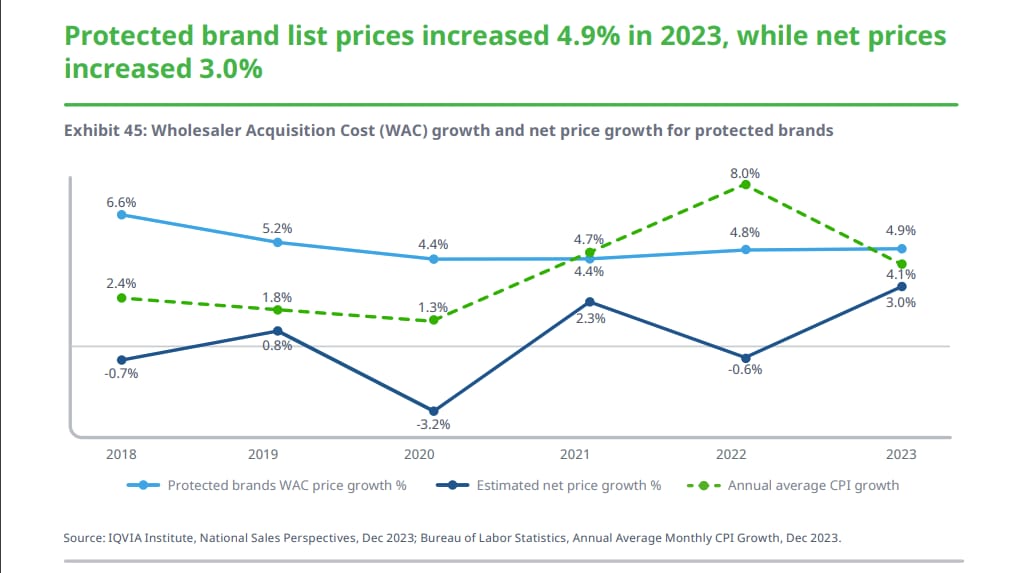

Here, the answers are clear, if unsurprising: med prices, at the net level, are pretty close to flat, especially taking into account inflation. Here’s where we’ve been over the past few years:

You can spin this as net prices being up, the reality is that the increase is still below inflation. And IQVIA suggests that this might be something of a high-water mark: prices are headed down over the next five years:

So we’re taking drops of between 1% and 4% a year on a net level, continuing a deflationary trend that is now almost a decade long. We may have issues with drug pricing in this country (more on that in a sec), but ever-increasing prices for brand medicines is not one of them.

So what’s driving the falling net prices? Rebates, obviously. We talk about that all the time, but estimating rebate amounts is a tricky business, and IQVIA has some great data here, too, on a therapeutic-area-by-therapeutic-area basis:

Now, the other way to tell this story is to note that spending (as opposed to price) is headed up faster than inflation. This is still mostly a good-news story. After all, more patients getting access to the medicines they need is the way that the system should work, ideally.

That drives spending in a handful of ways. First, there’s more volume as more patients get on therapy. Second, IQVIA documents that there will be more new medicines, which brings both innovation and new costs (the price of launch medicines is generally higher than older ones). And, third, there is a change in “mix” from older medicines to more powerful ones, which also brings more spending.

So it’s not like drug costs are not a factor in overall spending or spending growth. It’s just that the interaction is a lot more nuanced than we’re used to seeing in the press.

And speaking of nuance: what’s I’ve shared here is just a small snippet of the report, which includes details on everything from biosimilar use to nuggets on obesity. It’s worth refilling your coffee pot to go at the whole thing.

** True story: At J.P. Morgan this year, I pulled up a chair to scarf down some generic-buffet food at a satellite event in a non-descript hotel ballroom. I introduced myself to the guy already sitting there. “Hi,” he said. “I’m Murray Aiken, from IQ …”

“MURRAY AIKEN FROM IQVIA?!,” I said, maybe a bit too enthusiastically. “I’M A HUGE FAN!”

I turned to the two finance-bro types also at the table, minding their own business. “Do you guys read his stuff? It’s absolutely indispensable.” They looked up for a moment, mumbled something, and returned to their caesar salads.

Anyway: Murray was accommodating, given his celebrity, but I think that he was relieved to be finishing his meal as I sat down.

This seems excessive: Bernie Sanders, Liz Warren, and Jeff Merkley are demanding that the U.S. Chamber of Commerce give them all kind of details about their anti-march-in-rights campaign, suggesting that maybe the Chamber’s membership doesn’t back the effort because employers are concerned about the price of health care. But you know what else the nation’s businesses are concerned about? Efforts to kneecap the patent system. (h/t to Endpoints)

Speaking of Bernie (and speaking of excessive): Sanders is pushing the Danish government (via an opinion piece in the Danish press) to push Novo to push the price of its GLP-1 meds down in the United States. The whole Bernie/Novo thing is hugely interesting to me: there’s no real avenue for government intervention here, so Bernie is just trying, in every way, in every venue, to keep attention on the issue. I don’t know if that’s brilliant or tilting at windmills, but he’s getting press, so …

I don’t think there’s anything new in this Bloomberg Law article about the latest effort to use march-in rights to break Xtandi’s patent, but it’s a fairly exhaustive look at the topic, with the conclusion that HHS probably isn’t going to set off a bomb here (but no one thinks that’s beyond the realm of possibility)

If you’ve read this far, you’re a fan, and I appreciate you. Please consider forwarding to a friend and encouraging them to subscribe.