If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

I mentioned yesterday that this is going to be Deep Dive Data Week, and today is 340B day. Buckle up.

I was originally going to concentrate solely on IQVIA’s assessment of the 340B program, which dropped late last week, but a second report — this one from Berkeley Research Group — was released yesterday. So there’s a lot to talk about.

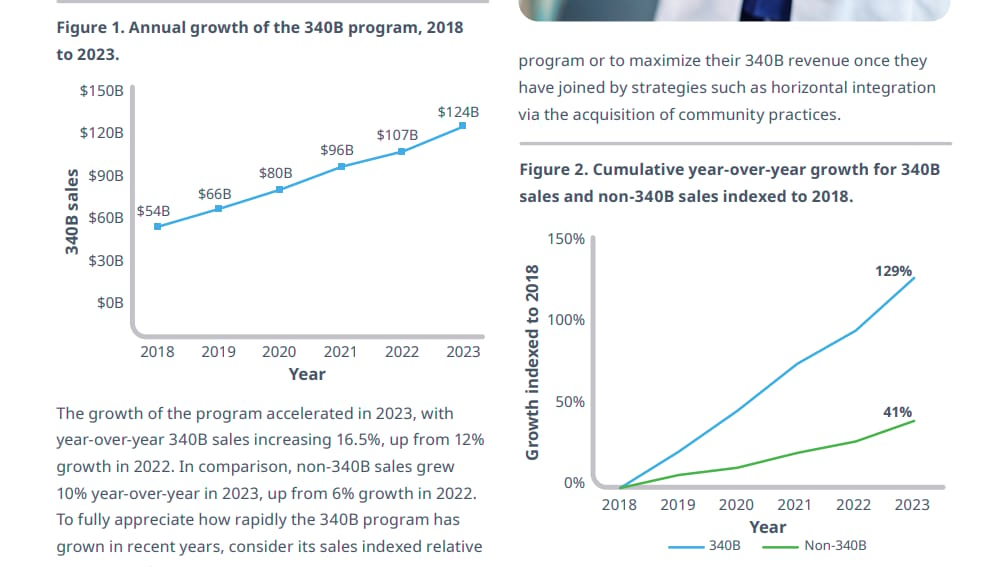

Let’s start with the IQVIA effort. The topline finding there is that the 340B program grew to $124 billion in sales at list prices in 2023**, a 16.5% increase over the year before. IQVIA also pointed out that over the five-year period since 2018, 340B sales are up 129%. That’s more than three times larger than the non-340B sales.

So, yeah, 340B is growing really fast. That growth is coming mostly from hospital and clinics, which saw growth of 18.9% in 2023, up from 14.3% in the year before. Retail and mail scripts — which are about a third of 340B sales — grew more slowly, perhaps because of manufacturer restrictions.

IQVIA also provided some useful details on the size of the rebates, which average about 55% but vary by therapeutic area. It estimated that cancer drugs, for instance, have an average discount around 40% which diabetes meds average discounts of 82%. This chart gets at the relative exposure — and growth — in various therapeutic areas:

So that’s the IQVIA take.

BRG’s report doesn’t provide new topline numbers — they’ve estimate in the past that there was $54.6 billion in 2022 340B spending, which accounts for the discounts — but the new publication puts that $54 billion number in context in a couple of ways.

First of all, it makes clear that 340B is the second-largest federal drug purchasing program. More dollars flow through the 340B program than flow through drug sales in Medicaid or Medicare Part B.

What makes that extraordinary is not necessarily the numbers (though those are extraordinary) but rather the continued obscurity of the program. We, as a nation, spend more than 340B drugs than the combined revenue of Major League Baseball, the NBA, the NHL, and the global Hollywood box office … combined. And, yet, no one has any idea. It’s kind of amazing.

The second interesting bit of the BRG effort was their estimate of 340B sales as a percentage of total outpatient sales. And here, the number is pretty amazing, too: about 18% of sales are made at 340B rates, up from 11.3% in 2017. So, again, the growth here, even over a relatively small period of time, is something else.

** 340B sales are generally reported in one of two ways. You can look at the value of 340B based on what the list price of the drugs sold would have been. That’s the way that IQVIA does it, and it gets you a bigger number. The other way is to look at how much was actually paid at the discounted 340B rate, which is how the government reports things out. That number, in 2022, was around $54 billion and Drug Channels and BRG talk about the size of the program based on that figure.

IQVIA imputed total spending at 340B prices for 2023 at $56.1 billion. That feels like it’s going to seem low when the official HRSA 2023 numbers are released later this year. IQVIA’s calculations are based on their own data, not the government’s numbers.

I think that Axios’ “Smart Brevity” approach is a really thoughtful way to present information, but it’s not necessarily great when it comes to nuance. There’s a new Axios Pro story about PBM delinkage, making the point that ensuring that PBMs aren’t paid based on rebates delivered (which can lead to gamesmanship around list prices) only works when paired with transparency measures.

The story noted that some of the congressional bills around PBM reform — which have both delinkage and transparency — have been scored as delivering big savings. The story then pivots to concerns raised by the PBM industry, which argues that PBM reform will merely raise premiums as PBMs pass increased costs on to customers, washing out savings.

I have a hard time holding both of those ideas in my head at once, and I’m kind of wishing that I had the Smart without the Brevity on this one.

(I also realize that I just asked you all to read 500 words on 340B, so this is definitely not a Smart Brevity kind of day.)

Elsewhere:

One of the easiest ways to get published is to take a therapeutic area, look at the Medicare statistics on what they pay for various medicines for that disease, compare those numbers to the cost of buying the medicines from Mark Cuban, and doing some simple multiplication, and showing that — yup — Medicare is massive overpaying for generics. The latest entry into this genre of studies looks at oncology meds and concludes that there is almost $900 million in savings available. More than half of that number is associated with one medicine: abiraterone (Zytiga).

If you’ve read this far, you’re a fan, and I appreciate you. Please consider forwarding to a friend and encouraging them to subscribe.