If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

There are two ways to look at yesterday’s FTC report on PBMs.

One way is to take it as the latest in a long line of overlapping signals that all tell the same story: PBMs are using their market power in a way that absolutely does not benefit consumers (and is wiping out pharmacists in the process).

In this view, the heat on PBMs only rises, and the consensus around the need for reform — aggressive reform — only grows more solid. It’s why politicians rushed to put out statements yesterday pledging action, and why “lame duck PBM reform” is going to dominate the headlines in December.**

The other POV is that the report didn’t really have a bombshell finding and didn’t change the state of play. The FTC has had a couple of years to work on it, and they’ve basically written a longer, more boring, less-read version of what the NYT pushed out last month.

The STAT story raises the possibility that this is it from the FTC. The agency didn’t suggest that any solid actions forthcoming, FTC Lina Khan could be out of a job in September, and there’s no guarantee that this undertaking will remain a priority.

To top it off, the share prices of the parent companies of the three largest PBMs rose yesterday. I wouldn’t read too much into that as a single datapoint, but it certainly suggests that Wall Street doesn’t anticipate the impending death of any golden geese.

The truth is probably somewhere in the middle: Reform, in some form or other, is coming. The big question is whether anything comes after that.

** j/k: We’ll still be fighting over the election in December.

***

It’s also worth noting the statement of PCMA, which you can read here. My sense is that the PBM industry is just not being particularly responsive to the accusations being leveled at it. There’s a heavy vibe here of an industry that doesn’t have a strong data-grounded rebuttal to the specific elements of the accusations being thrown at it.

As a compare-and-contrast, here is how AHIP responded to Monday’s WSJ story about Medicare Advantage. It’s clear AHIP has answers. (I don’t know if they’re good answer or valid answers — MA is not a wheelhouse of mine — but it’s clear that AHIP trying to address the specifics criticisms being leveled.)

While we’re talking PBMs, there is a new PhRMA/Morning Consult poll that shows that pretty much every PBM practice is wildly unpopular and that people are generally in favor of their elected officials administering a legislative beatdown to that industry.

All of that is well and good and probably unsurprising. I’m sure it builds the case, in some small way, for the continued pursuit of PBM reform. The pressures there are all pressing in the same direction.

What was more interesting to me was a bit of the poll about how many Americans have had up-close-and-personal experience with some of the more aggravating PBM practices around access.

The giant poll — more than 20,000 people were surveyed — found that more than half of all Americans had experienced some sort of “insurance barrier.” Twenty percent had dealt with a formulary exclusion. Another 20% had to wait on a prior auth. One in ten have had to deal with a copay accumulator program.

I don’t doubt that the FTC report will have an impact on the conversation around PBMs. But it feels like the true soft underbelly of the PBM industry is the reality that PBM cost-control efforts are really hitting a lot of Americans … and hitting them hard.

(There’s other interesting hints in the poll, too, including some data on unease with PDABs and other price-control approaches.)

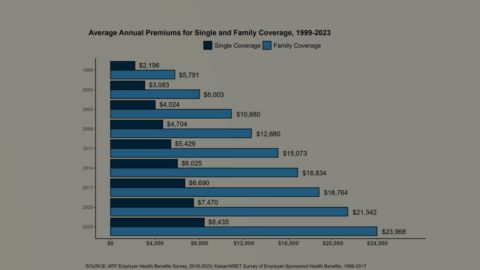

This Wall Street Journal op-ed inveighing against the IRA may not be the most elegant essay, but it may be one of the densest, shoehorning concerns about patient out-of-pockets, impact on innovation, rising premiums, and a reduced number of Part D plans … all in less than 750 words.

Johnson & Johnson is back in the good graces of the South African government, which, per STAT, stopped threatening the company’s IP after J&J cut the price of its tuberculosis drug. This is not the kind of item that I always include here, but the battle over tuberculosis meds is low-key fascinating because it represents an offshoot of one of the more interesting pharma-oriented “influencer” campaigns of the past decade: novelist and podcaster John Green’s longstanding effort to improve global access to TB meds.

If you’re a company that wants to help the Tufts Center for Drug Development with its latest effort to estimate the price of drug development, they’d love your assistance. More details here. Tufts hasn’t gone through this exercise since 2014 (when they pegged the average per-drug cost at $2.6 billion), so this should be an illuminating process.

Header image via Flickr user Mr. Blue MauMau.

Thanks for reading this far. I’m always flattered when folks share all or part of Cost Curve. All I ask is for a mention or tag. Bonus points if you can direct someone to the subscription page.