If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

Fair warning: this newsletter doesn’t have much on the 2024 presidential race today. If you’re looking here for election-related prognostication or snark or analysis or whatever, you’re going to be disappointed.

Indeed, I’ll make just two points.

First, I can’t imagine that Joe Biden’s exit will change the health policy dialogue, with the giant exception of abortion, over the next 100 days or so. Trump is probably going to mostly ignore drug prices, and presumptive nominee Kamala Harris is probably going to hammer the same milestones Biden would have: Medicare price controls and what I assume will be a march-in announcement at some point.

Second, the PBM industry is probably the biggest winner in the whole holy-moly-Biden-is-out storyline. Because those folks are going to show up on the Hill tomorrow, and you and I may be the only ones paying attention.

No line I wrote last week generated more inbound email than the conclusion to my assessment of PBM reactions to the FTC’s PBM report: “Where are the big employers in all of this?”

That’s the important question, because the quickest and most lasting way to change the PBM business model is going to be employers taking a more active role in PBM selection. And that means we need to have a lot more insight into what’s happening at employers.

So there are a couple bits of illumination on that question this morning.

The first is a STAT story that unearthed a March report from the Office of the Inspector General for the Postal Service, which found that Express Scripts overcharged the mail folks by $45 million. The largest bit of that was due to Express Script’s GPO hanging onto rebate dollars that OIG said should have been passed through.

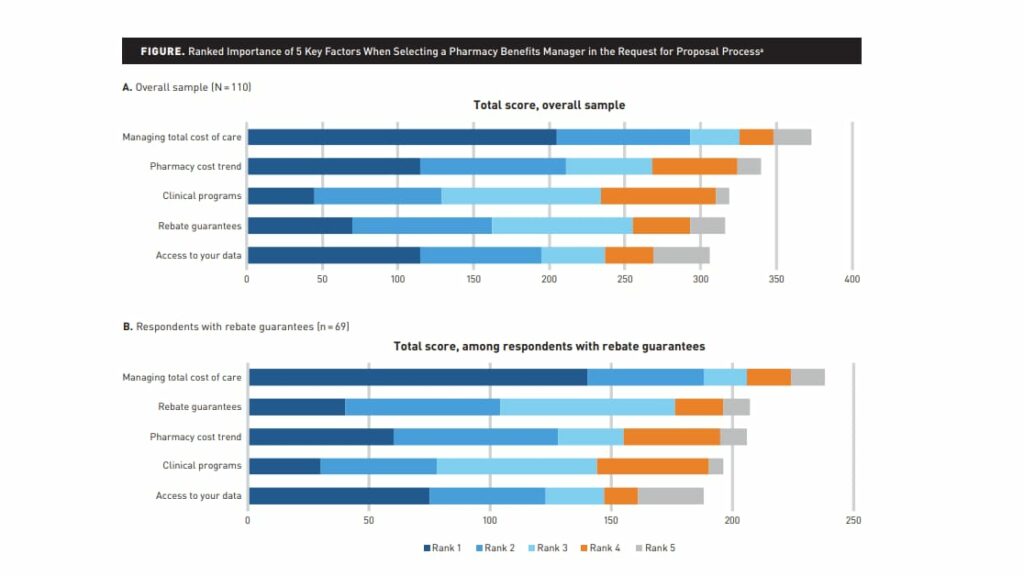

The second is a thoughtful study in the American Journal of Managed Care by John O’Brien and his colleagues at NPC. It surveyed more than 100 employers about their PBM arrangement and found a general dependence on rebates and a general dependence on benefits consultants (which have generated headlines lately for the way that their pockets are lined with big-PBM dollars).

Because there is so much to digest in the piece — it’s well worth the click — I asked John to summarize what he and his team found: “Readers of Cost Curve who have been following the gross-to-net conversation won’t be surprised by the high percentage of employers reporting PBM contracts with a rebate,” he told me in an email.

“Two other findings might stand out: Just how many large employers are outsourcing these decisions and not scrutinizing these PBM contracts, and the relationship between an employer using a benefits consultant — who may have financial relationships with PBMs — and how much they valued rebate guarantees.”

***

It’s worth spotlighting one other bit from the AJMC paper, which suggests that if the potential of saving money won’t change employer/PBM/broker dynamics, threats of legal action might. The impact of CAA wasn’t the focus of the research, but this is absolutely a new frontier worth boning up on:

Most plan sponsors are subject to the Employee Retirement Income Security Act of 1974 (ERISA), which established federal standards for employer health plans. As such, employers have a fiduciary responsibility to operate the plan solely in the best interest of participants and beneficiaries. The Consolidated Appropriations Act of 2021 amended ERISA, creating new requirements for covered service providers such as employer consultants and benefits brokers to disclose to plan sponsors any direct or indirect compensation they receive, but unlike employers who hold a fiduciary responsibility, consultants and brokers do not hold a fiduciary relationship with employees, thus there is no obligation to prioritize the employer’s interest over their own. In light of recent legal action, employers may wish to better understand the financial incentives of their consultants and brokers when accepting their recommendations for rebate contracting strategies and pharmacy benefit design.

I put a link to this Bloomberg editorial on “negotiations” up on my LinkedIn page on Friday, and the analytics on it were fascinating: it generated plenty of impressions but almost no likes, which is kind of a “Coward’s Ratio” type of reaction.

I suspect that’s because it’s an analysis that has something to make everyone angry, but it’s sophisticated enough to layer in enough caveats and carve-outs to make knee-jerk reactions difficult.

The thesis is essentially that “negotiation” is generally a good thing, PBMs are pretty bad at it, the IRA has basically the right idea, but we’d be better off with a system that used incentives more thoughtfully.

For the record, I’m a coward here, too. The editorial is not something I can wholeheartedly endorse, but there are a lot of elements of the argument that are worth discussing.

Thanks for reading this far. I’m always flattered when folks share all or part of Cost Curve. All I ask is for a mention or tag. Bonus points if you can direct someone to the subscription page.