If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

Today’s clip-n-save research comes from Nature Review Drug Discovery, which just published an absolute goldmine of a paper looking at industrywide R&D spending. This has always been a tough number to get at simply because the biopharmaceutical industry is kind of an iceberg: there is a lot of work going on below the surface (at private companies, outside the United States, etc.)

So the new effort — spearheaded by Janssen folks, along with Harvard’s Amitabh Chandra and Analysis Group — looks at the whole iceberg and estimates that, in 2021, more than $276 billion was spent on R&D.

That’s way more than the usually cited figure of about $100 billion, which accounts for the spending by PhRMA membership. And that’s almost six times more than the NIH’s budget.

The other datapoint worth thinking on is the measurement of R&D intensity — that is, R&D spending divided by revenue — which is 27% globally and 34% in the United States. By the standards of any other industry, those are dizzyingly high numbers.

The whole thing is worth a read, but if you are caffeinated and must rush, Janssen’s Ulrich Neumann, one of the authors, hits the key points well in a LinkedIn post.

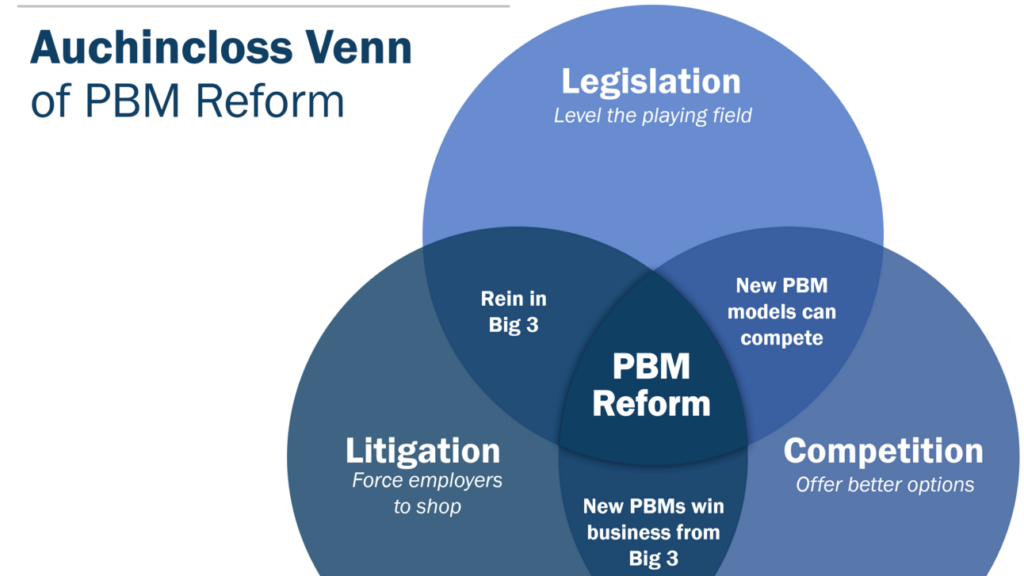

I’m fascinated by Rep. Jake Auchincloss’ effort to get his mind around the best way of getting PBMs to change their business practices. He put up an interesting poll last week (I mentioned it on Monday) that surveyed folks on what the most effective route to PBM reform would be: legislation, litigation, or competition.

It quickly became clear that no one thinks that PBM reform can happen without some combination of the three, and Auchincloss shared a Venn diagram of how those three elements link together yesterday. This is what it looks like:

But even that misses some components. The FTC is still out there, and it’s not clear exactly what tools they can or will deploy. (A lawsuit over rebates seems likely, but I’m not convinced that’s a silver bullet.) Still, it’s worth considering that impact.

I also have a vague sense that we’re moving toward a system that has a cash-pay component to it. This is happening mostly clearly around generic drugs, though the long-range implications of DTC models for brand-name products are fun to think about. Does that enter the picture?

So I’ve tried to create a more complex “Modified Auchincloss”:

But even that diagram probably leaves out some elements. Could HHS/CMS take regulatory steps to enable competition (or encourage litigation)? Where does state-level regulation/litigate get us? The mind reels.

I love this way of visualizing things … and I’m open to edits. Hit me up.

I’ve been purposely avoiding discussion of some of the recent work by Bentley University’s Fred Ledley — notably this article and this working paper — making the case that price controls won’t have much of an impact on drug development. Ledley’s conclusions seemed so divorced from the reality of the industry that I was hoping no one would notice, so I was reticent to engage.

But STAT gave Ledley a First Opinion slot today. I guess I should probably detail a bit of my discomfort.

The Ledley argument, put incredibly simply, is that 1) the R&D decisions of smaller biotech companies aren’t influenced by revenues, and 2) smaller biotechs do most clinical trials.

Therefore, cutting revenues (via price controls) shouldn’t change R&D decisions at biotechs, which, in turn, shouldn’t change the number of clinical trials much, which, in turn, means that drug approvals wouldn’t be much affected.

This probably deserves a longer takedown by someone more thoughtful than me, but let me step in the breach here and say … the Ledley argument feels shaky.

On (1), I have never seen a serious analysis that suggests that clinical-stage biotechnology is driven by anything other than potential revenues. Perhaps earlier-stage companies are valued by their science alone, but once you hit proof of concept, it’s all about the Benjamins. On (2), Ledley has a weirdly homogenous definition of smaller biotech that might be confusing the issue.

Anyway: I’d welcome a more sophisticated take.

Elsewhere:

This deserves a more comprehensive take (maybe tomorrow?), but CMS is under attack from the right for its effort to “stabilize” Part D premiums in light of IRA-related pressures. The highest-profile of the objections comes from the Wall Street Journal, which lobbed a grenade at the agency in this editorial that accused CMS of “revising Democrats’ handiwork to mitigate the political harm before the election.”

Amgen went on the record about the IRA on its earnings call yesterday. As with most other executive comments, it was a combination of assessing short-term impacts from price controls (CMS will announce a “maximum fair price” for Enbrel in a week or two) as well as long-term concerns. “This is not a good mechanism to incentivize and reward innovation and it does not resemble one we’ve commonly described as a negotiation,” EVP Murdo Gordon told analysts. “We will look to see how PBMs redesign their formularies, and we will look to see how patients are impacted by the new model. While the cap may help, the out-of-pocket for many patients may actually rise.”

Thanks for reading this far. I’m always flattered when folks share all or part of Cost Curve. All I ask is for a mention or tag. Bonus points if you can direct someone to the subscription page.