I know there’s other things we could talk about, but the only thing I want to discuss is the truly seismic news today. Here are ten quick thoughts on the CMS “Maximum Fair Price” announcement:

There’s plenty of reading. I’d start with the CMS fact sheet with the actual prices. As of this very moment, I don’t think there is one media story that is substantially more sophisticated than any other, so click whatever link you like and you’ll get pretty much the same info. I’ll probably be able to direct you to standout coverage tomorrow when folks have had more time to digest.

The White House took an interesting communications strategy here: they released the overall “$6 billion in government savings/$1.5 billion in savings for seniors” numbers in advance, under embargo, and then dropped the “negotiated prices” in a second wave a couple of hours after the embargo lifted. I can’t tell if this is genius, giving the government two bites of the apple, or counterproductive, given that the initial round of headlines wasn’t as dramatic as it could have been.

I’m leaning toward the latter**: my feeling has always been that talking about huge discounts is better and more tangible than raw numbers. I don’t think most people can really visualize what $6 billion or $1.5 billion means anyway. (Kate-McKinnon-as-Elizabeth-Warren described this well on SNL: “You know, when the numbers are this big, they’re just pretend. There ain’t no Scrooge McDuck vault. You ready to get red-pilled? Money doesn’t exist. It’s just a promise from a computer.”)

While we’re on those numbers: the $1.5 billion number — savings directly to seniors — is almost certainly overstated. It’s based on the assumption that all Part D beneficiaries have the “standard benefit,” which is very much not the case. So we know that number is off. We just don’t know how much that number is off. (On the flip side, that number is just from savings from price controls. There will absolutely be savings related to the $2,000 out-of-pocket cap, and I don’t want to confuse those two.)

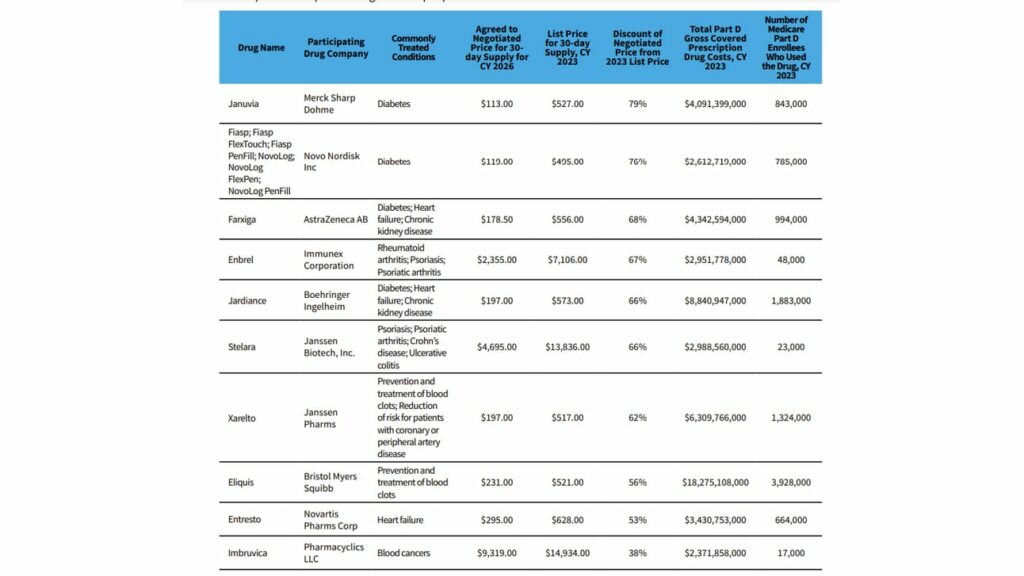

The big, unanswered question is “Did the government get a good deal?” The CMS fact sheet said that the numbers are a 22% discount from existing net prices, which doesn’t sound like huge savings were extracted, especially given that — in the absence of the IRA — net prices would have fallen regardless. That’s not a knock on CMS or a suggestion that price controls are a “meh” phenomenon. These first 10 meds were an oddball group, with most of the names already highly rebated. There wasn’t much juice left to squeeze.

The net price calculus is also a little fraught, so that 22% number may be less than 22% in reality, when some of the other factors that go into the benefit design get factored in. Inma Hernandez has a good LinkedIn post up explaining how discounts might end up overstated.

Harvard’s Ben Rome has a summary of his own effort to figure out which drugs are truly taking hits from the price controls, suggesting that Stelara, Entresto, and Imbruvica are going to get whomped hard, while the drugs that already have pretty big discounts (Farxiga, Jardiance, Novolog/Fiasp, Xarelto) might not see much/any impact. Rome said he is using SSR data, which might not fully represent some of the unique elements of Medicare rebating/discounting, so I’m not taking anything to the bank. I look forward to the full analysis.

There’s basically nothing out there today on the way the market may shift. Lower prices on these 10 medicines may mean more use and more adherence (and therefore a higher base of revenue). Or we could see all manner of PBM shenanigans designed to push patients away from the 10 selected medicines. I don’t think anyone has any idea how those dynamics will work, but I don’t want to lose that thread.

Wall Street is pretty sanguine about the whole thing. I’m beginning to see some analyst notes trickle in. The first one in my inbox — from BMO Capital Markets — has this as a headline: “You Can Stop Holding Your Breath Now – IRA Prices in Line With Expectations.” The markets appear to have yawned. Again, this doesn’t mean that there’s not an impact. It’s just pretty much what Wall Street anticipated.

I’m watching the politics of this, too. How will this show up in Kamala Harris’ stump speeches. How the Republicans push back? (We have some hints on that. Here’s a WSJ editorial from yesterday, and the topic of Part D stabilization remains a lightning rod.)

** The Associated Press didn’t think much of the administration’s drip-drip-drip approach. Here’s the lede on its initial story: “The Biden administration is taking a victory lap after federal officials inked deals with drug companies to lower the price for 10 of Medicare’s most popular and costliest drugs, but shared few immediate details about the new price older Americans will pay when they fill those prescriptions.

Thanks for reading this far. I’m always flattered when folks share all or part of Cost Curve. All I ask is for a mention or tag. Bonus points if you can direct someone to the subscription page.