If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

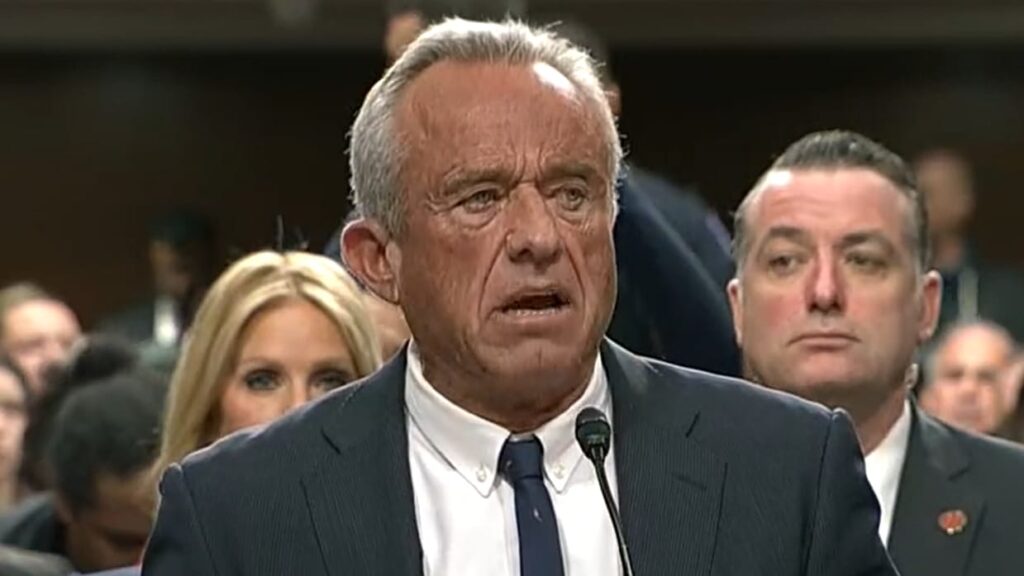

So I guess we have to talk about Robert Kennedy, Jr.’s first confirmation hearing (he has a second one today). In a lot of ways, I’d rather not, because there’s really nothing new here. STAT has the details if you want details.

I went back and read what I sent out the day after his nomination broke, and it seems like the state of play remains pretty much exactly the same. You either think that his vaccine denialism is disqualifying or you don’t. (There is a right answer here, BTW.)

I suspect that no vote will turn on Kennedy’s views on Medicaid.

Indeed, if there is anything that the hearing exposed, it’s that Kennedy doesn’t appear to care, particularly, about Medicare or Medicaid. He tripped up on the basics of the programs frequently, sending policy wonks into an eye-rolling tizzy. It was so bad that the New York Times wrote a whole article about it. Politico did, too, with a lot more sass.

That means, I suspect, that Kennedy (if confirmed) isn’t going to drive any CMS policy there. He’ll probably be a good soldier in implementing anything that comes down from above, and I imagine that Mehmet Oz (if confirmed) and the appointees close to the actual Medicare and Medicaid programs won’t have a lot of supervision.

Exactly what does that mean? Nobody knows. (Sorry. Couldn’t help myself. Trying to retire the GIF.)

Yesterday, I noted without comment some new policies from Cigna/Evernorth/Express Scripts designed “to help ensure patients receive the benefit of the savings Express Scripts generates through its negotiations.”

Here’s what Express Scripts is promising:

1. Patients will be protected from paying the high list price of their medication, and will instead get access to the lower price negotiated by Express Scripts.

2. Patients in employer-sponsored plans will have improved financial predictability, receiving the benefit of the savings on medication costs that Express Scripts negotiates, if they don’t already. This will be particularly meaningful to patients during their deductible phase when the cost of medications can be at their highest. …

3. Provide patients a personalized summary that details each patient’s annual total prescription drug costs, including medication prices, negotiated savings inclusive of discounts and rebates, plan paid amounts, and total savings.

4. Provide plan sponsors with an annual standardized report disclosing costs and pharmacy claim-level reporting, which will create additional transparency beyond the routine reporting and insights Express Scripts already delivers.

Am I a skeptic? Yup. But I want to give credit where it’s due: this acknowledges some of the big issues people have with PBMs. When I spoke to Stacey Richter for her podcast a couple of months ago, I listed three changes to the health system where there is (almost) universal agreement. And one of them was “no patient should be exposed to list prices.”

So box checked. Kind of.

The question is whether Express Scripts will hide the ball here. Sure, this will be a part of the group’s “standard offerings,” which isn’t the same as universal inclusion in all plans. The Bloomberg coverage suggested that this could shift costs from patients back to employers, which is good for patients, but they’re not the ones picking the benefit design.

And I’m curious about the operational element. If I’m still in my deductible and go to the pharmacy, they’ll have a semi-public net price for me? That reflects a negotiated price? My coinsurance will be based on the net price?

This is where 46Brooklyn’s Antonio Ciaccia gets stuck. Express Scripts doesn’t do the negotiating, by and large. It’s the company’s GPO, Ascent, that does that work. So exactly what is Express Scripts committing to? Here’s Antonio:

I did a control-F [in the Evernorth release] for “Ascent” and couldn’t find anything. So what exactly is ESI negotiating with manufacturers? My understanding is that Ascent is the negotiator. If anything, minus further detail to the contrary, this just means Ascent’s scraps are being passed through. …

We know from Nephron, media reporting, and the OIG audit of ESI that manufacturer revenue has shifted to GPOs and specialty pharmacies and away from the traditional PBM. If the broader vertical can control the dials of what is and isn’t part of what’s passed through, it’s disingenuous to frame it as “our hands are clean – we’re passing the net cost ESI negotiates through.”

I’m here to be proven wrong though, and I will absolutely post the first pharmacy receipt that I see showing a true net price. And I will also amplify any employer or plan sponsor who celebrates the additional reporting.

One of the less-discussed elements of IRA price controls is the government’s ability to go in an “renegotiate” prices, starting with the 2028 year (which kicks off next winter). Brookings has a nice, detailed overview on what that will entail.

Teva’s CEO is confident that the company can make a compelling case for Austedo, one of the next 15 drugs to be negotiated. “We think we have a very good dossier to help them understand the value we bring,” Richard Francis told Endpoints. On the flip side, the Pink Sheet noted that Austedo could be compared by the government to a generic drug, making the price-control process a lot more complex.

Obamacare health plans are denying a lot of claims. KFF pegs that number at 20%, on average. Not good.

One of my bigger worries about health innovation is that our inability to come up with systems that can deliver life-changing gene therapies is going to set the technology back a generation. There are a lot of little issues to address, and this well-done report from NPC does an excellent job of trying to capture all of those items. The group’s map of the patient/caregiver journey has about 40 steps, and screwing up any one of those 40 means we’re missing an opportunity. Kudos to Tyler, Brian, and Jon for the work.

Cost Curve is produced by Reid Strategic, a consultancy that helps companies and organizations in life sciences communicate more clearly and more loudly about issues of value, access, and pricing. We offer a range of services, from strategic planning to tactical execution, designed to shatter the complexity that hampers constructive conversations.

To learn more about how Reid Strategic can help you, email Brian Reid at brian@reidstrategic.com.