Happy Friday! I’m hoping to tap into the collective wisdom of the Cost Curve subscriber base again: I’m curious about the health-related podcasts that you listen to.

I have a survey here for you to pass along your listening habits, and I’ll share the results if I can get a critical mass.

One of the harder truths to explain about 340B is the way that the program messes with employers. In brief, employers — via the PBMs they hire — negotiate rebates on prescription drugs. Those rebates, in turn, are generally used to either lower premiums or expand coverage.**

Take a medicine like Humira. Every script might generate $3,000*** in rebate dollars that flow back to employers.

But if that Humira script flows through a 340B entity instead, the hospital gets the discount, even as the insurance company pays the list price. The $3,000 shifts from the employer side of the ledger to the 340B hospital side. That’s $3,000 less that the employer has in its budget.

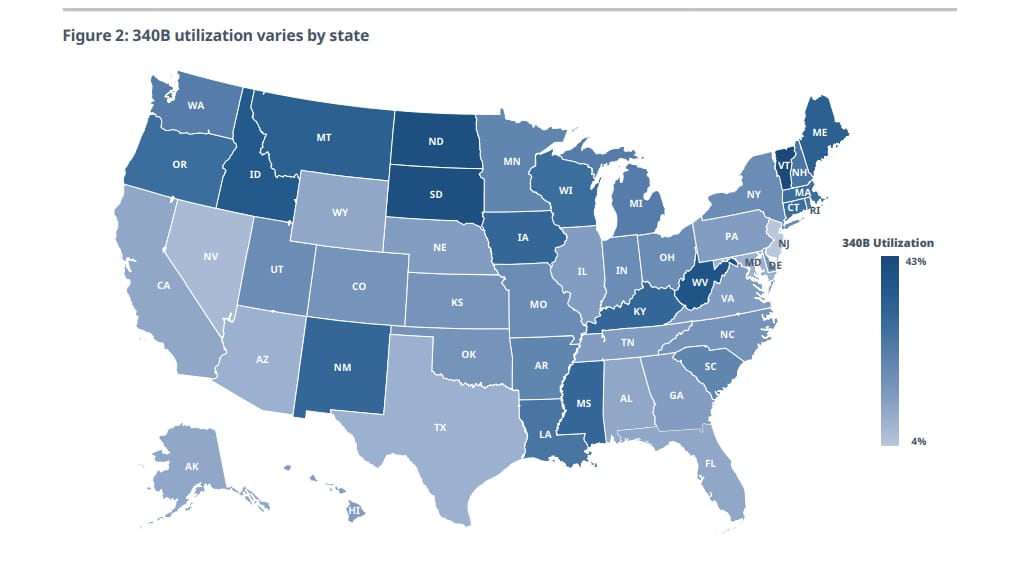

All that is prelude to a new IQVIA study commissioned by the National Pharmaceutical Council that looked at this impact on employers on a state-by-state basis. The upshot is that employer-sponsored plans saw costs increase by about $6.6 billion in 2023 because of 340B. Throwing state and local governments in raises the cost figure by another billion dollars.

There’s a huge amount of variation by state: Vermont leads the nation, with the average beneficiary incurring $152 a year in additional costs due to 340B, compared with a national average of $43.

The IQVIA report also quantifies the way that state laws that remove the ability of manufacturers to set rules around the use of contract pharmacies will make these numbers bigger.

This helps illustrate that 340B is effectively a tax on employers used to fund hospitals, though it happens in a dizzyingly complex and altogether unintended way.

There may be an argument that this is — in theory — all well and good****: that 340B hospitals need support and that employers ought to play a role in providing that support. But our current system seems like a particularly random and inefficient way of doing that.

** I’m leaving out the pernicious effect of chasing higher rebates — as opposed to lower prices, which is not the same thing — which is a hugely important topic … for another day.

*** Numbers here are for illustration purposes only.

**** Alternative argument: This is not remotely well and good. Employers are already stressed by health costs. If society wants to support hospitals, we can do it in far smarter ways.

I’m supposed to pay some attention to the chaos going on in the federal health agencies, especially at CMS, as DOGE seeks deeper and deeper access to systems in the name of savings. In theory, this is a great opportunity to ask smart questions about where the waste in government health programs really lies, and whether talk of fraud is a red herring.

But to pivot immediately to those topics is to normalize a situation that first ought to be considered as a violation of norms, if not laws, around who has access to CMS data and systems and what they can do with it.

There will be time, no doubt, to dive into the waste, fraud, and abuse conversation. Today isn’t that day.

ELSEWHERE

PBM reform is back! Or, at least advocacy around PBM reform is back, with a coalition of employers and other health-system stakeholders writing letters to Trump and Congress pushing for inclusion of PBM reform in the next big spending bill. (It sounds like they want the same language that was spiked from the last big spending bill.)

IRA reform is back, too! The Orphan Cures Act, which would remove disincentives for rare disease drugs that were baked into the IRA, has been reintroduced in the House.

There’s been a lot of 340B legal action: hospitals are trying to get in on the lawsuits over the rebate rule, and J&J, Lilly, and BMS all filed their motions for summary judgment in those cases.

Are insurance companies kind of doomed? Axios tackled that question in depth today, and it’s a good read. It sure seems like the forces pressuring insurance company margins are likely to persist. On the other hand, we’re not talking about companies in any risk of operating in the red.

Also not really operating in the red: Hospitals, per Fierce.

This is nice work from Vox on how tariffs will lead to drug shortages.

Off-topic, but this David Wainer WSJ piece is a smart take on the rise of China as a biotech powerhouse. There is an unasked policy question here: Is there a risk that anti-innovation sentiment in the United States will further fuel the trend?

Speaking of “anti-innovation” sentiment, here is a good overview of why seizing patents is bad for innovation, via Kirsten Axelsen and Peter Pitts.

Cost Curve is produced by Reid Strategic, a consultancy that helps companies and organizations in life sciences communicate more clearly and more loudly about issues of value, access, and pricing. We offer a range of services, from strategic planning to tactical execution, designed to shatter the complexity that hampers constructive conversations.

To learn more about how Reid Strategic can help you, email Brian Reid at brian@reidstrategic.com.