A quick note: The number of folks who opened Cost Curve yesterday fell precipitously. I’m not worried about the statistics, but I do suspect that the experimentation with the easier-to-read layout may have landed Monday’s edition in the wrong inbox for some of you.

So if you don’t remember getting Cost Curve yesterday, please make sure that you’re dragging the newsletter in your primary tab, if that’s how your email is set up (Gmail and Apple both offer that option). If that doesn’t work, you may want to check your spam.

As for yesterday, here’s a link to that newsletter for those who missed it.

Onward.

INFLECTION POINT/ Whither Inflation Penalties in the Commercial Market?

Health Affairs has an extensive analysis of what would happen if the IRA’s inflation penalties — which require a rebate if list prices exceed inflation — were implemented in the commercial market.

The topline number is that such a policy, had it been in place in 2021, would have saved $8.1 billion. A handful of different scenario analyses were also done assuming that only a subset of medicines faced inflationary penalties and, in all cases, the authors suggested $4 billion+ in annual savings.

I can see the appeal of the idea, but there seem to be two problems.

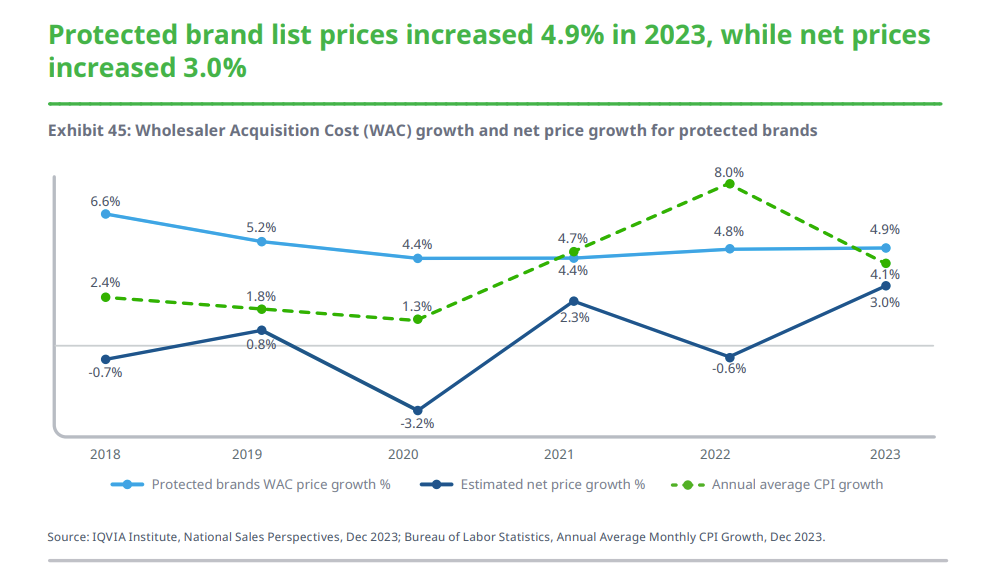

The first is that the study looked at data between 2017 and 2021, when list price increases did indeed outstrip inflation. But if you look at the two years that followed, inflation was actually higher than the average list price increase. (In 2024, the two numbers were close to the same.)

Here is the IQVIA chart that makes this crystal clear:

There are all kinds of interesting and worthwhile explanations for what is going on, but the upshot is that the existing dynamics holding down list prices seem to be here to stay.

So it’s possible that, as a policy solution, inflationary penalties are directed at an issue that is, at best, receding.

The second objection is the usual one: list prices are a lot less important than net prices. There are absolutely games that are played with the list-to-net spread that mostly harm patients, and doing away with those games would be a clear benefit. But it’s unlikely to deliver huge systemwide savings. That might not have been the case 10 years ago, but it’s smallball now.

QUICK TURNS/ The IRA and OOPs, GLP-1 Coverage, and Some Updates

First, some quick updates.

Yesterday, I flagged that one Medicare “negotiation” fix — the MINI Act — had been reintroduced, but I wasn’t clear on what that bill does. The bill is designed to give certain small molecules — any drug that “incorporates or utilizes a genetically targeted technology” — the same degree of protection from price controls that biologics now receive.

I also talked about the new ICER report that looks at Breo and Trelegy in the context of the upcoming CMS “negotiation.” Endpoints covered that release, leaning into the finding that those medicines appear to bring benefits beyond those seen with alternatives.

And I praised the transparency and detail in the way that Mesoblast approached the pricing decision for its stem cell therapy, Ryoncil. But Nationwide Children’s Hospital’s Michael Storey did the math and came away with a far dimmer impression of the price.

Last week, we talked about a little e-book from Optum on the recent history of pharmacy benefit management. Adam Fein noticed it, too, and the comments on his LinkedIn post are a fun read.

ELSEWHERE:

Medicare Part D plans are already pushing higher out-of-pocket costs onto patients who are on medicines that will be subject to “maximum fair prices” next year, according to a report put out by the Council for Affordable Health Coverage that is fueled by Magnolia Market Access data. Magnolia said that plans are shifting patients from copays to coinsurance, and that’s going to boost monthly OOP spend as much as 76%. Here’s the key chart:

I’m not sure what to make of this GoodRx analysis that shows GLP-1 coverage on a product-by-product basis. In the aggregate, the work feels right. Like KFF, it suggests that about 20% of those with employer plans have no coverage. But it suggests there are some between-drug differences, with coverage for Zepbound declining and coverage of Wegovy increasing. That doesn’t comport with the way that sales numbers are moving, so I don’t know how useful the granular details are.

Healthcare Brew is tracking on a dispute between pharmacies and PBMs over contracts. Pharmacies want to be able to cancel their PBM contracts immediately, without cause. PBMs (which can already do that) oppose such a change. CMS is due to decide the issue in the next month or two.

Are you in public affairs? Do you love 340B? If so, I have a job posting for you!

Cost Curve is produced by Reid Strategic, a consultancy that helps companies and organizations in life sciences communicate more clearly and more loudly about issues of value, access, and pricing. We offer a range of services, from strategic planning to tactical execution, designed to shatter the complexity that hampers constructive conversations.

To learn more about how Reid Strategic can help you, email Brian Reid at brian@reidstrategic.com.