If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

THE ARC/ Over Time, (Most) Drug Prices Go Down

I’m at the Tufts CEVR annual meeting today, which is a good excuse to promote some critical research that just came out of that group. (Emerging academic superstar Ching-Hsuan Lin just talked about this at the meeting.)

Ching, Josh Cohen, and the team took a look at 32 high-spend drugs — all meds that are or will probably get a Medicare “maximum fair price — and asked a simple question: On a net price basis, what happens to prices between drug launch and loss of exclusivity?

In some ways, the answer here — just published in Value in Health — is probably obvious to you all but baffling to the general public.

Prices, on average, fell an inflation-adjusted average of 4.7% a year (the median drop was 2.4%). Again, this is not a surprise: most of the big-selling drugs are heavily rebated, and falling net prices is a fact of life for a huge chunk of the pharmaceutical market. The effect isn’t universal: 25 of the 32 drugs analyzed fell over their branded lifecycle.

Here’s an SSR chart that makes the point in aggregate. The IQVIA chart here (Exhibit 45) does the same. Pretty sure those are not inflation-adjusted. The Tufts work adds to this by taking things on a drug-by-drug basis.

There are big asterisks worth noting. Drugs with Medicare-protected class designations tended to rise over time. Cancer drugs tended to rise more aggressively over time. Price decreases tended to moderate over time.

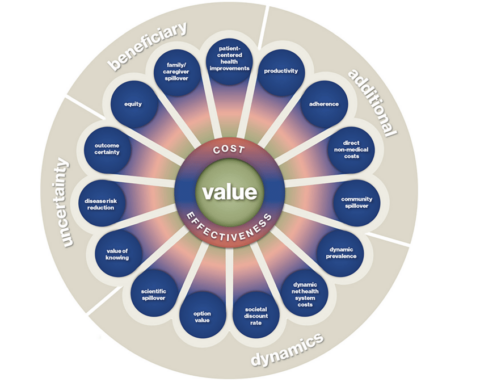

The researchers suggested that one immediate application of the data might be cost-effectiveness analyses, which tend to overestimate costs by assuming today’s price will be tomorrow’s price (and the price the day after that, and the day after that, until the heat death of the universe). This work suggests that a dynamic model could increase the accuracy of such calculations.

But, for me, it’s two reminders: (1) Most drug prices aren’t rising, no matter what you might have read, and (2) this isn’t a universal, and we should pay more attention to the heterogeneity in price changes.

INFLECTION POINT/ The Get-PBMs-to-Divest-Pharmacies Bandwagon Gets Bigger

I have an idea to sell you.

It has the support of a senatorial odd couple, Liz Warren and Josh Hawley. About 90% of the legislators in Arkansas back it. And –yesterday — the attorneys general of 39 states and territories — including the top lawyers in New York, California, North Dakota, and Mississippi — said they were also in favor.

The idea? Forcing PBMs to divest pharmacies.

The AG letter is the “news” here, dropping yesterday. They’re calling for congressional action to help promote competition, alleging that the PBMs are using their market power to warp pharmacy.

The problem here is pretty well-established, with the FTC’s report being the best accounting.

But the solutions have been less clear, which makes the sudden ardor for the divestment idea all the more important.

This all feels like a lot, so I don’t know how realistic a proposal this is at the federal level. I don’t know what kind of legal pushback might be brewing.

But in a world where there are very few health policy solutions with broad, bipartisan support, this one might be worth circling.

QUICK TURNS/ The Obligatory Tariff Link

Once again, I’m supposed to write about tariffs, especially in light of the Trump administration’s revelation that it has launched a “Section 232” investigation designed to lay the groundwork for duties on meds. But there is basically zero certainty about the timing, extent, or goals of such an effort, so I have nothing to offer you. That’s just the way 2025 is going to go, I guess.

Speaking of people being mad at PBMs for their behavior around pharmacies, the government of Canada is investigating Express Scripts for driving patients to its mail-order options, among other small efforts to allegedly kneecap competition. STAT’s Ed Silverman has the scoop. It’s good, in these troubled times, to see that Americans and Canadians have something in common.

When KFF’s Larry Levitt talks, I listen. His new JAMA Forum piece is well worth the read, laying out the long history of backlash against payers and suggesting that we might have arrived at a moment of action. “A renewed set of consumer protections such as a patient’s bill of rights,” Levitt wrote, “would certainly be well received by a frustrated public.” Where do I sign?

Cost Curve is produced by Reid Strategic, a consultancy that helps companies and organizations in life sciences communicate more clearly and more loudly about issues of value, access, and pricing. We offer a range of services, from strategic planning to tactical execution, designed to shatter the complexity that hampers constructive conversations.

To learn more about how Reid Strategic can help you, email Brian Reid at brian@reidstrategic.com.