If you want to search Cost Curve back issues or link to anything you read here, the web links and archive are online at costcurve.beehiiv.com. You can subscribe there, too.

INFLECTION POINT/ It Sure Looks Like the IRA Has Wounded Post-Approval Research

The Inflation Reduction Act passed nearly four years ago, in August of 2022. That means that companies have had a chance to chew on the implications of the law and begin to adjust behaviors to the IRA’s incentives.

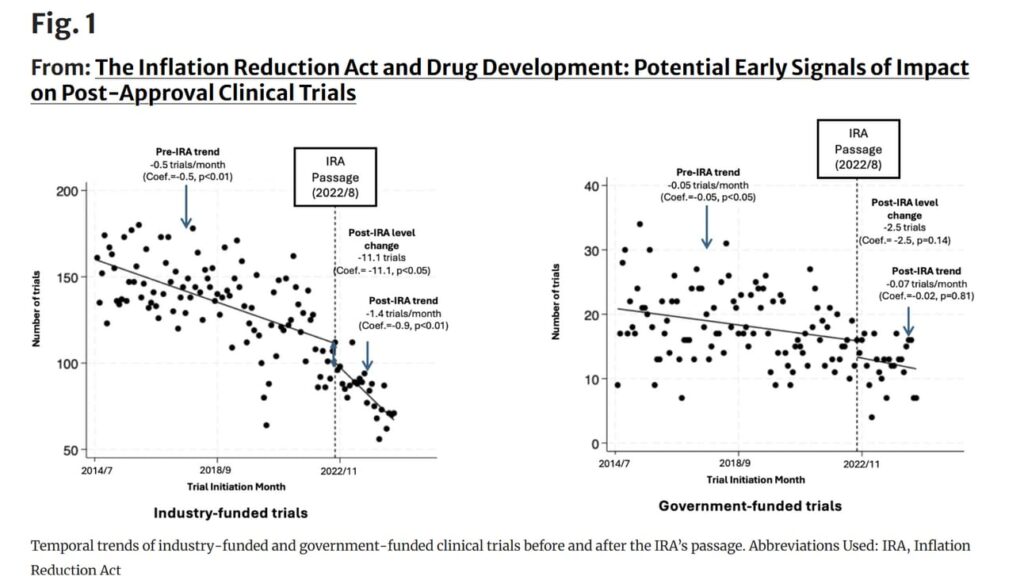

Those changes probably show up most dramatically at a few points in the drug-development cycle, and one of those points is post-marketing studies. If you know that the tail of a drug’s revenue stream is going to get chopped off at nine years, there’s probably a lot less willingness to invest in deep research after approval.

The idea that the IRA might impact post-marketing studies is an easy proposition to test, and there’s news today from the folks at the National Pharmaceutical Council, who did indeed test that proposition, looking at industry-sponsored post-approval trials.

The results were compelling. This is a picture-is-worth-a-thousand-words thing, so here’s the key visual:

You should, as they say, read the whole thing.

The reality is that there are a bunch of confounders here. The NPC work tried to suss them out, mostly by using government-sponsored post-marketing trials as a comparison group, but also running various scenarios around the impact of COVID and interest rates.

But even accounting for those tweaks, the reduction in post-approval research remained.

There are probably other hypotheses here that you could pose, but the most obvious explanation for the data is that — yup — the IRA is starting to kill post-approval research.

REBOUND/ A Deeper Look at How Optum Rx Is Faring

UnitedHealth Group reported earnings last week, and we talked a little bit about that at the time, but I was so busy making my usual philosophical objection that I didn’t go back and delve into a lot of the details there.

So here are some additional elements worth peeling back from the investor call.

On Optum Rx’s performance, where revenues were up by earnings were down on falling margins, I wondered whether anything odd was afoot. Optum Rx got nothing but good vibes on the call, including this bit on projections:

So there you have it. The PBM is apparently doing better than expected. Make of that what you will.

On PBM reform, the company presented its usual talking points (“we are leading in the marketplace with transparency, choice, and affordability”), but there remains some concern about the Arkansas law barring PBMs from owning pharmacies that’s worth a mention.

I’m not entirely sure what the unwinding looks like here, but the whole answer kind of sidesteps the actual concern that undergirds the law: Vertical integration creates a huge incentive for anticompetitive behavior. Patient impact in Arkansas may be a practical issue to work through, but it’s a red herring in the context of the larger “problem they’re trying to solve.”

On tariffs, it’s probably just worth noting the glee with which the company addressed the subject.

“Better than pretty good” … is pretty friggin’ good for 2025, I’d say.

QUICK TURNS/ AZ is Back at PhRMA, And How Inflation Penalties Can Cause Price Hikes

AstraZeneca is back in the fold at PhRMA. It’s meaningful that the industry is getting more united as the number of existential threats grows.

This is an absolutely fascinating Ed Silverman story of a company with a 20-year-old medicine that has taken so many price increases that it must pay Medicaid huge sums every time the drug is used. In response, the company that now owns the drug — Eton — is hiking the price in the commercial market to stay in the black. It’s a version of the unintended-consequences-of-inflation-penalties thing (here’s another version). I’m not sure there’s a broader takeaway here, but — man — we have a weird health care system.

One of my core arguments against international reference pricing is European-style prices are the beginning of a slippery slope to a European-style system, and I’m not sure Americans want that. Indeed, there’s an argument to be made that maybe the Europeans should be a little more like Americans … that’s an argument that is fleshed out in a compelling and concise fashion in a letter by Sanofi’s Paul Hudson and Novartis’ Vas Narasimham from today’s Financial Times. Worth the read.

I’ve had a tab open with this ATI Advisory analysis of the 2024 research and dealmaking landscape up on my browser for a while. I’m not aligned with the blithe conclusion that the IRA isn’t that big a deal (see above), but the underlying data is helpful context.

Cost Curve is produced by Reid Strategic, a consultancy that helps companies and organizations in life sciences communicate more clearly and more loudly about issues of value, access, and pricing. We offer a range of services, from strategic planning to tactical execution, designed to shatter the complexity that hampers constructive conversations.

To learn more about how Reid Strategic can help you, email Brian Reid at brian@reidstrategic.com.